Https Inc42 Com Buzz Unicommerce Ipo Promoter Acevector To Make 4 6x Returns Softbank To Mint 3 5x Gains

Unicommerce IPO: AceVector Set to Make 46X Gains, SoftBank to Exit with 35X Returns

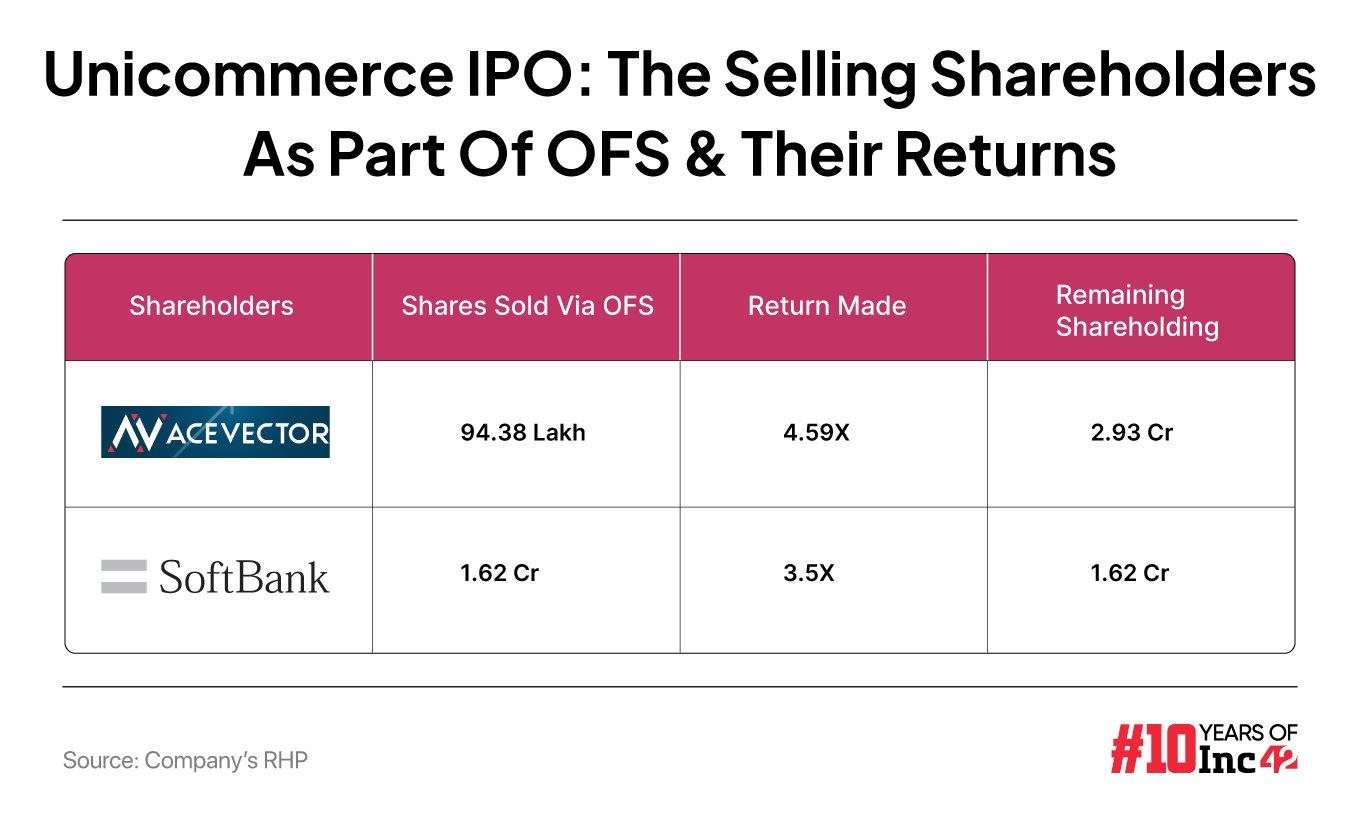

AceVector's Windfall

AceVector Limited, the holding company of former e-commerce giant Snapdeal, is poised to make substantial profits from the initial public offering (IPO) of Unicommerce. AceVector, which acquired Snapdeal in 2017, is expected to earn 46 times its investment in the SaaS startup.

SoftBank's Strategic Move

SoftBank, another major investor in Unicommerce, will make a 35X return by selling a portion of its stake in the IPO. This move is seen as a strategic exit for SoftBank, which is seeking to reduce its exposure to the e-commerce sector while protecting its executives from potential liabilities.

Unicommerce's Shareholding Structure

Unicommerce Esolutions is a leading e-commerce enterprise software developer. It has a diverse shareholding structure, with SoftBank holding a 30% stake and Snapdeal, through AceVector, holding a 35% stake. The remaining shares are held by other investors.

Average Acquisition Cost

According to the IPO prospectus, Snapdeal's average cost of acquisition for its shares in Unicommerce is Rs. per share. This low acquisition cost will further amplify AceVector's gains from the IPO.

Https Inc42 Com Buzz Unicommerce Ipo Promoter Acevector To Make 4 6x Returns Softbank To Mint 3 5x Gains

Comments